How Do Zappy Cards Work?

October 31, 2024Zappy cards offer a convenient and often rewarding way to make payments, but How Do Zappy Cards Work? This guide will delve into the mechanics of zappy cards, exploring their benefits, potential drawbacks, and how they compare to traditional payment methods. We’ll also look at the technology behind them and offer some tips on using them safely and effectively.

Understanding the Basics of Zappy Cards

Zappy cards, also known as prepaid or reloadable cards, function similarly to debit cards but with a key difference: they’re not linked to a traditional bank account. Instead, you load money onto the card beforehand, and you can spend only up to the available balance. This pre-funding aspect makes them a popular choice for budgeting, online shopping, and controlling spending.

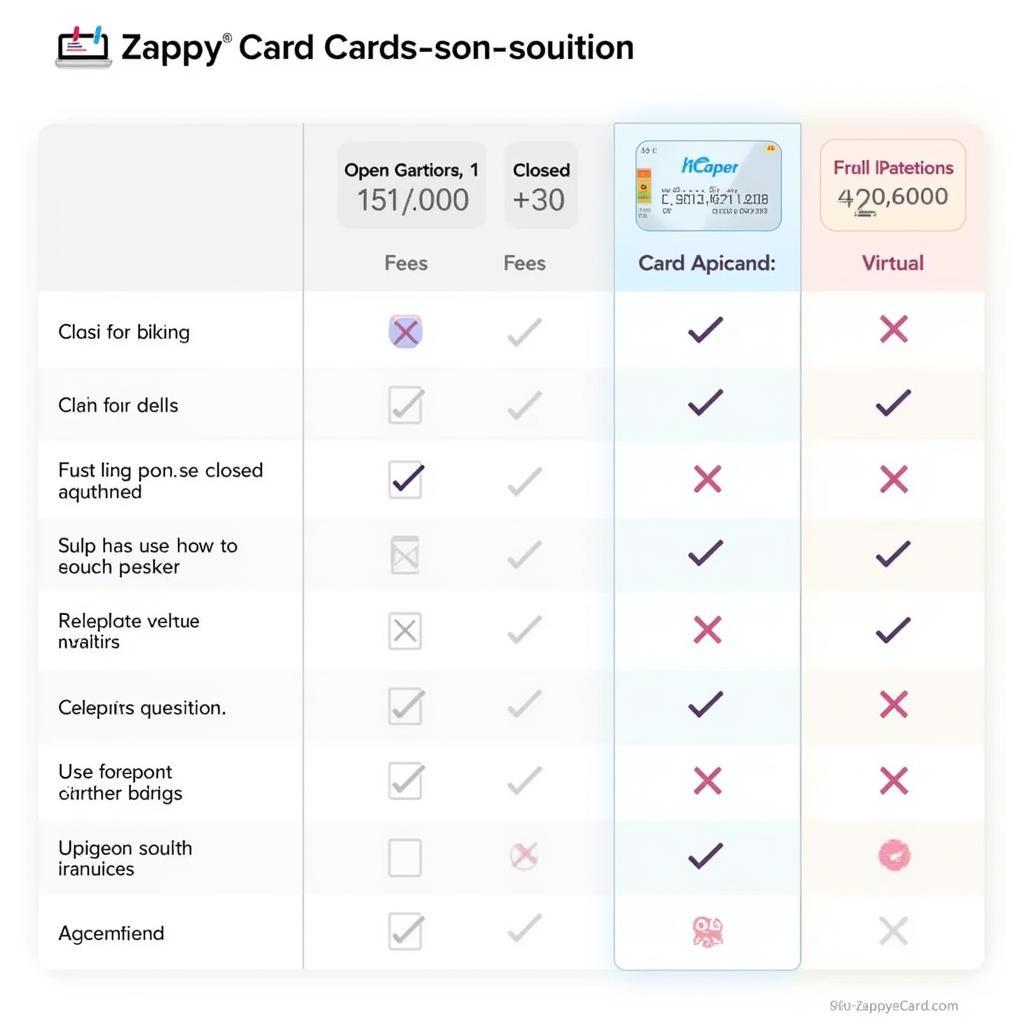

Several types of zappy cards exist, each catering to specific needs. Open-loop cards, such as Visa or Mastercard branded zappy cards, are accepted virtually anywhere these card networks are supported. Closed-loop cards, on the other hand, are typically retailer-specific, meaning you can only use them at designated stores or within a particular merchant network.

Zappy Card Types Comparison

Zappy Card Types Comparison

The Technology Behind Zappy Cards

Zappy cards utilize sophisticated technology to ensure secure transactions. Each card is associated with a unique account number and, often, a personal identification number (PIN). When you make a purchase, the card reader communicates with the card network to verify the available balance and authorize the transaction. This process happens almost instantaneously, providing a seamless payment experience.

Many zappy cards also incorporate EMV chip technology, which adds an extra layer of security against fraud. The chip generates a unique code for each transaction, making it much harder for criminals to clone or counterfeit the card.

Benefits of Using Zappy Cards

Zappy cards offer a multitude of benefits. For budget-conscious individuals, they provide a tangible way to track spending and avoid overdraft fees. They’re also excellent for online shopping, as they limit your financial exposure in case of data breaches.

Furthermore, zappy cards can be a valuable tool for teaching financial responsibility to teenagers or managing expenses for specific purposes, like travel or entertainment. They offer a sense of control and independence, while also promoting responsible spending habits.

“Zappy cards can empower individuals to take control of their finances and make informed spending decisions,” says renowned financial advisor, Sarah Johnson, CFA. “They’re a practical tool for budgeting and managing expenses, especially in today’s digital landscape.”

Potential Drawbacks of Zappy Cards

While zappy cards offer many advantages, it’s important to be aware of potential drawbacks. Some cards may come with fees for activation, reloading, or inactivity. It’s crucial to compare different cards and choose one that aligns with your spending habits and budget.

Another consideration is the limited purchase protection offered by some zappy cards. Unlike credit cards, which often provide robust fraud protection and dispute resolution mechanisms, zappy cards may have limited recourse in case of unauthorized transactions.

How Zappy Cards Compare to Traditional Payment Methods

Zappy cards offer a unique blend of convenience and control that sets them apart from traditional payment methods. Unlike debit cards, they’re not tied to a bank account, offering a layer of separation between your spending and your primary finances. Compared to credit cards, they prevent overspending and the accumulation of debt.

“In a world where digital transactions dominate, zappy cards provide a sensible alternative to traditional payment methods,” explains Michael Lee, a leading expert in fintech. “They offer a balance between convenience and financial control, appealing to a wide range of consumers.”

Conclusion

Understanding how zappy cards work is crucial for leveraging their benefits effectively. They offer a practical and secure way to manage finances, control spending, and navigate the increasingly digital world of payments. By carefully considering the various types of zappy cards, their fees, and their features, you can choose the perfect card to suit your needs. So, make the smart move and explore the world of zappy cards today!

FAQ

- Can I use a zappy card internationally?

- Are there age restrictions for obtaining a zappy card?

- How do I reload my zappy card?

- What happens if I lose my zappy card?

- Can I transfer funds from my zappy card to my bank account?

- What are the typical fees associated with zappy cards?

- How do I check the balance on my zappy card?

Suggest other relative articles

- Understanding Prepaid Card Fees and Charges

- Choosing the Right Zappy Card for Your Needs

- Zappy Cards and Online Security: Tips and Best Practices

Call to Action

For any assistance or further queries regarding zappy cards, please contact us:

Phone: 0963418788

Email: [email protected]

Address: 2M4H+PMH, Phường Nghĩa Thành, Gia Nghĩa, Đắk Nông, Việt Nam.

Our customer support team is available 24/7 to assist you.