Coyyn Digital Banking: A New Way to Manage Your Finances

November 8, 2024Coyyn Digital Banking is transforming the way we handle our money. It offers a sleek, modern approach to banking that puts you in control, offering flexibility and convenience at your fingertips. Whether you’re a seasoned financial expert or just starting out, understanding the benefits of coyyn digital banking can significantly improve your financial life.

What is Coyyn Digital Banking?

Coyyn digital banking provides all the traditional banking services you’d expect, but without the need for a physical branch. From checking your balance and transferring funds, to paying bills and applying for loans, everything can be managed through a user-friendly app or website. This means you can bank anytime, anywhere, making it a perfect solution for today’s fast-paced world. This accessibility and convenience are just some of the reasons why coyyn digital banking is gaining popularity.

The Advantages of Coyyn Digital Banking

Coyyn digital banking offers numerous advantages over traditional banking methods. Let’s explore some key benefits:

- 24/7 Accessibility: Manage your finances anytime, anywhere, without being limited by branch opening hours.

- Lower Fees: Digital banks often have lower overhead costs, resulting in reduced fees for customers.

- Faster Transactions: Say goodbye to lengthy queues and paperwork. Enjoy instant transfers and payments with just a few taps.

- Increased Transparency: Track your spending and manage your budget effectively with real-time updates and intuitive dashboards.

- Enhanced Security: Benefit from advanced security measures like biometric authentication and multi-factor authentication, protecting your funds from unauthorized access.

- Personalized Experience: Many coyyn digital banks offer personalized financial advice and tools to help you reach your financial goals.

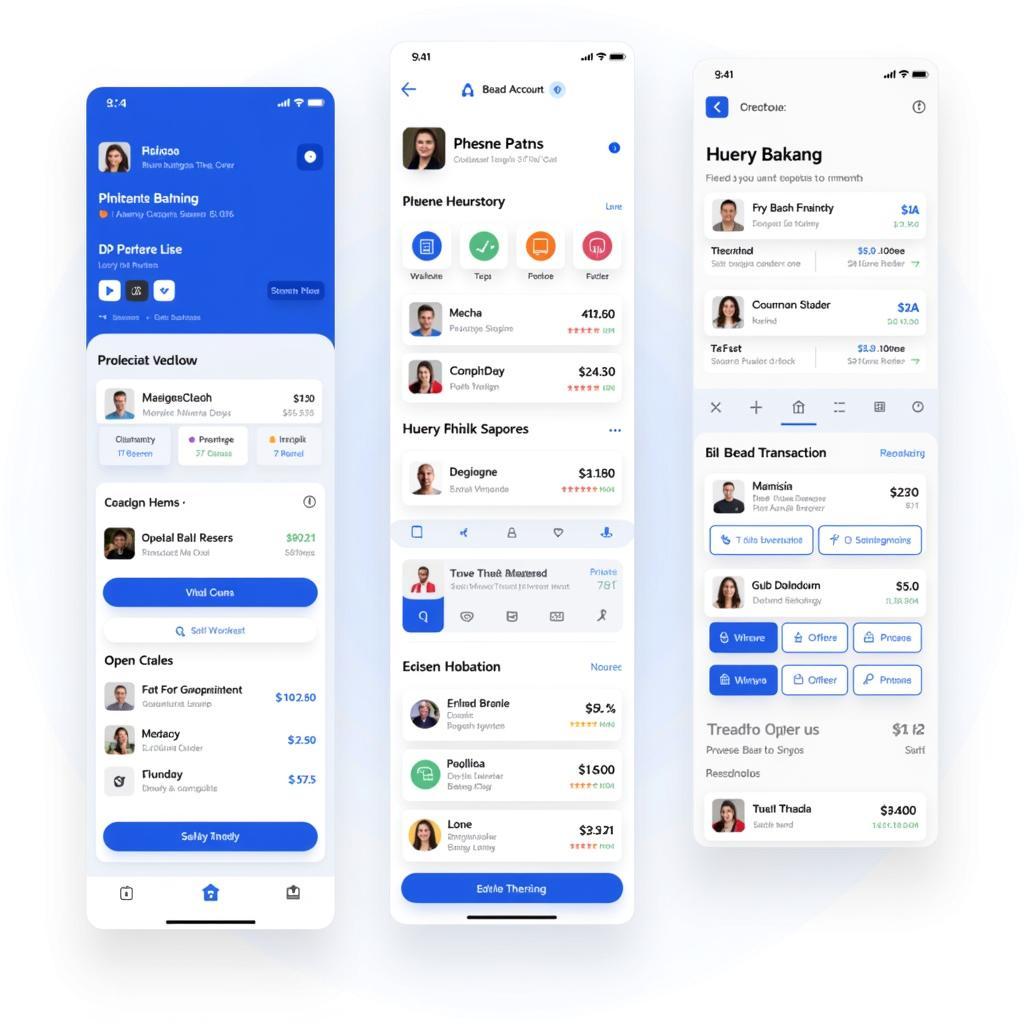

Coyyn Digital Banking Mobile App Interface

Coyyn Digital Banking Mobile App Interface

Coyyn Digital Banking vs. Traditional Banking

While traditional banks still hold their place, coyyn digital banking provides a distinct alternative. A key difference is accessibility. With coyyn digital banking, you’re no longer constrained by geographical location or opening hours. This freedom is particularly beneficial for those who travel frequently or have busy schedules. Another critical distinction is cost. Traditional banks often have higher fees associated with various services, while coyyn digital banking frequently offers lower or even no fees, making it a more economical option.

Is Coyyn Digital Banking Secure?

Security is a top priority for any banking platform, and coyyn digital banking is no exception. These platforms employ robust security measures, including encryption, biometric authentication, and multi-factor authentication, to safeguard your financial information. Furthermore, many coyyn digital banks are regulated by the same authorities as traditional banks, providing an additional layer of security and peace of mind.

How to Choose the Right Coyyn Digital Bank

Choosing the right coyyn digital bank can be daunting. Consider these factors:

- Security Features: Ensure the bank uses robust security measures to protect your data and finances.

- Fees and Charges: Compare fees for different services, such as transfers, withdrawals, and account maintenance.

- Customer Service: Look for banks with responsive and helpful customer support.

- Features and Functionality: Choose a bank that offers the features and tools you need to manage your finances effectively.

- Reviews and Ratings: Read reviews from other users to get a sense of their experiences.

“A well-chosen coyyn digital bank can empower you to take control of your finances and achieve your financial goals.” – Dr. Anya Sharma, Financial Economist

Conclusion

Coyyn digital banking represents a significant shift in the financial landscape, offering a modern, convenient, and often more cost-effective alternative to traditional banking. By understanding its advantages and choosing the right platform, you can leverage the power of coyyn digital banking to simplify your financial life and reach your financial aspirations. Coyyn digital banking is more than just a trend – it’s the future of finance.

FAQ

- What is the difference between coyyn digital banking and online banking?

- Is my money safe with a coyyn digital bank?

- How do I open a coyyn digital bank account?

- Can I access my coyyn digital bank account from anywhere in the world?

- What are the fees associated with coyyn digital banking?

- How can I contact customer support for my coyyn digital bank?

- What are the benefits of using a coyyn digital bank over a traditional bank?

Need Support? Contact us 24/7: Phone: 0963418788, Email: fandejong@gmail.com Or visit us at: 2M4H+PMH, Phường Nghĩa Thành, Gia Nghĩa, Đắk Nông, Việt Nam. We have a dedicated customer support team ready to assist you.