Mastering the Art of Form 668 Z

October 16, 2024Form 668 Z. This seemingly cryptic phrase might not ring a bell for everyone, but in certain circles, it carries significant weight. Just like a perfectly weighted pass on the football pitch, understanding the nuances of Form 668 z can unlock opportunities and lead to favorable outcomes.

Form 668 Z Essentials

Form 668 Z Essentials

Deciphering the Code: What is Form 668 Z?

Let’s kick things off by demystifying Form 668 z. Imagine this: you’re navigating the complex world of tax regulations, specifically dealing with the IRS and the potential release of a federal tax lien. That’s where Form 668 z enters the scene.

Form 668 z, officially titled “Notice of Agreement of Subordination of Federal Tax Lien,” plays a crucial role in establishing priority among creditors. Think of it as a strategic play on the financial field. When you, as a taxpayer, need to secure a loan or credit while a federal tax lien is in place, Form 668 z becomes your game plan.

When Form 668 Z Takes Center Stage

Understanding the specific scenarios where Form 668 z becomes relevant is key to unlocking its full potential:

- Securing a Loan: When seeking a loan, especially for real estate, a pre-existing federal tax lien can pose a significant hurdle. Form 668 z allows a lender to have priority over the IRS, making loan approval more likely.

- Refinancing Existing Debt: Similar to securing a new loan, refinancing often requires a clear understanding of lien priority. Form 668 z can pave the way for a smoother refinancing process.

- Selling Property: A federal tax lien attached to a property can deter potential buyers. Form 668 z can facilitate a sale by ensuring the buyer that their interests are protected.

Understanding Lien Priority with Form 668 Z

Understanding Lien Priority with Form 668 Z

The Power of Subordination

The essence of Form 668 z lies in its ability to subordinate the federal tax lien. But what does “subordination” truly mean in this context?

In simple terms, subordination means rearranging the pecking order. It’s about shifting priorities. When a federal tax lien is subordinated, it essentially takes a backseat to another creditor’s claim. This doesn’t erase the tax lien but repositions it in the line of creditors waiting to be paid.

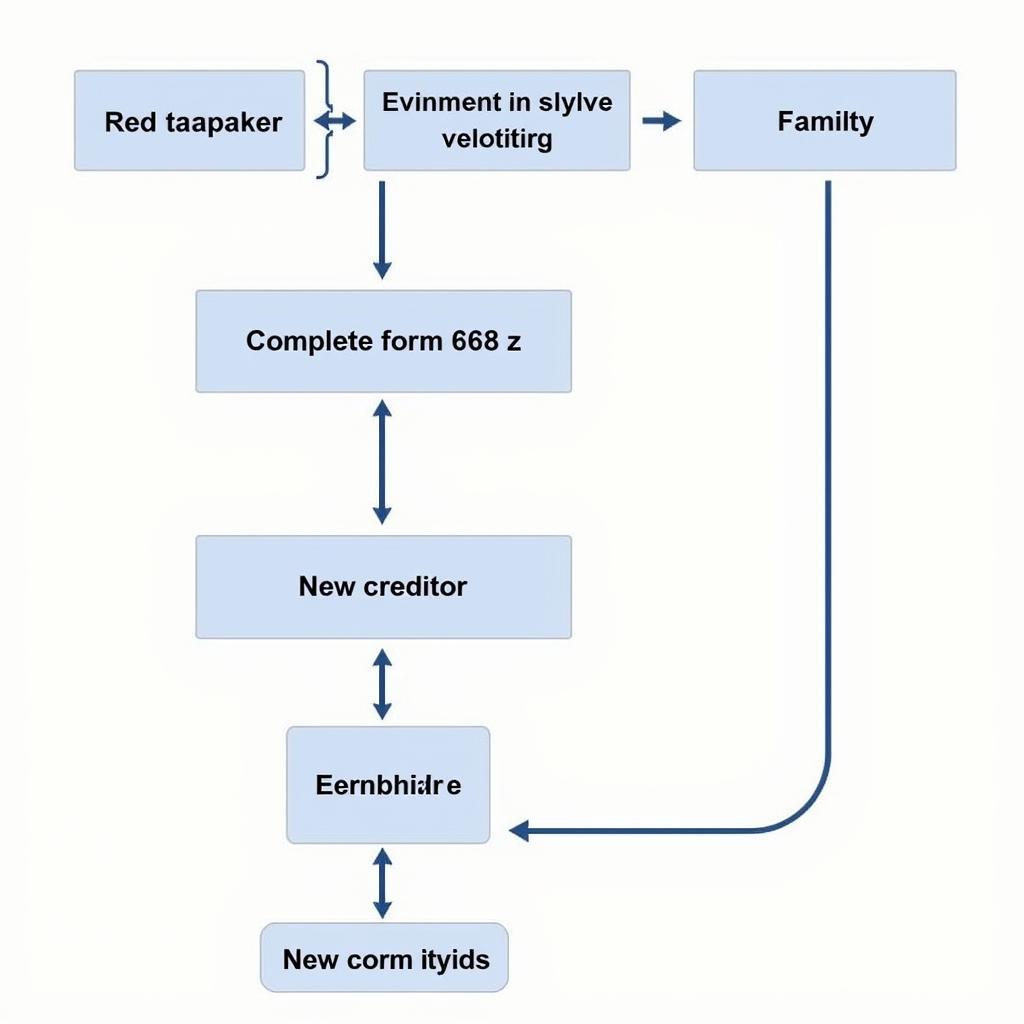

Navigating the Intricacies of Form 668 Z

While Form 668 z itself might not be overly complicated, the process surrounding its completion and approval requires careful attention. Here’s a breakdown of the key players and steps involved:

- The Taxpayer: As the individual or entity with the federal tax lien, you initiate the process by requesting the IRS to consider subordination.

- The New Creditor: This could be a lender, another individual, or an organization seeking priority over the IRS’s claim.

- The IRS: Ultimately, the IRS holds the power to approve or deny the request for subordination. Their decision hinges on factors like the amount of the tax lien, the value of the property involved, and the potential risk to the government’s interest.

Navigating the Form 668 Z Process

Navigating the Form 668 Z Process

Seeking Expert Guidance

Just as a football team relies on a skilled coach, navigating the intricacies of Form 668 z often necessitates expert guidance. Tax attorneys, Certified Public Accountants (CPAs), or Enrolled Agents (EAs) possess the specialized knowledge to provide tailored advice and ensure compliance with IRS regulations.

Beyond Form 668 Z: Exploring Related Concepts

Understanding Form 668 z often opens the door to a wider world of financial and legal concepts. Here are a few related terms worth exploring:

- Federal Tax Lien: A legal claim imposed by the IRS on a taxpayer’s assets when they fail to pay their tax liabilities.

- Certificate of Subordination: A legal document confirming the subordination of one debt or claim to another.

- Lien Release: The official removal of a lien after the debt is fully paid or other conditions are met.

Form 668 Z: A Strategic Tool in Financial Planning

In the grand scheme of financial planning, Form 668 z emerges as a strategic tool, empowering individuals and businesses to navigate challenging situations involving federal tax liens. By understanding its purpose, requirements, and implications, taxpayers can make informed decisions and potentially unlock opportunities that might otherwise seem out of reach.

Remember, knowledge is power, and in the realm of finance, that power translates into greater control and potentially a more secure financial future.

FAQs about Form 668 Z

1. How long does it take for the IRS to process Form 668 Z?

The IRS typically processes Form 668 Z within 30 to 60 days of receiving a complete application.

2. Can I submit Form 668 Z electronically?

Currently, Form 668 Z must be submitted to the IRS by mail or fax.

3. What happens if the IRS rejects my Form 668 Z application?

If your application is rejected, you can appeal the decision or explore alternative options with your creditor.

Need Further Assistance?

We’re here to help you navigate the intricacies of Form 668 Z and other financial matters. Contact us at Phone Number: 0963418788, Email: [email protected], or visit us at our office located at 2M4H+PMH, Phường Nghĩa Thành, Gia Nghĩa, Đắk Nông, Việt Nam. Our dedicated customer support team is available 24/7 to assist you.