Master the Art of Learned Buy Sell and Trade

November 28, 2024Learned buy sell and trade strategies are crucial for success in today’s dynamic markets. Whether you’re a seasoned investor or just starting out, understanding how to effectively buy, sell, and trade assets requires continuous learning and adaptation. This article will delve into the essential principles, strategies, and insights needed to navigate the complexities of trading and investing.

Understanding the Learned Buy Sell and Trade Cycle

The learned buy sell and trade cycle isn’t just about making quick profits. It’s a continuous process of acquiring knowledge, analyzing market trends, and making informed decisions. This involves understanding fundamental analysis, technical analysis, and risk management principles. It’s about learning from your mistakes and constantly refining your approach.

Fundamental Analysis: The Foundation of Learned Trading

Fundamental analysis focuses on evaluating the intrinsic value of an asset. This involves examining various factors, such as a company’s financial statements, industry trends, and macroeconomic conditions. By understanding the underlying fundamentals, you can make more informed buy and sell decisions.

- Analyze company performance: Look at revenue, earnings, and debt levels.

- Understand industry dynamics: Identify growth opportunities and potential risks.

- Assess macroeconomic factors: Consider interest rates, inflation, and economic growth.

Analyzing Stock Market Fundamentals

Analyzing Stock Market Fundamentals

Technical Analysis: Reading the Market’s Signals

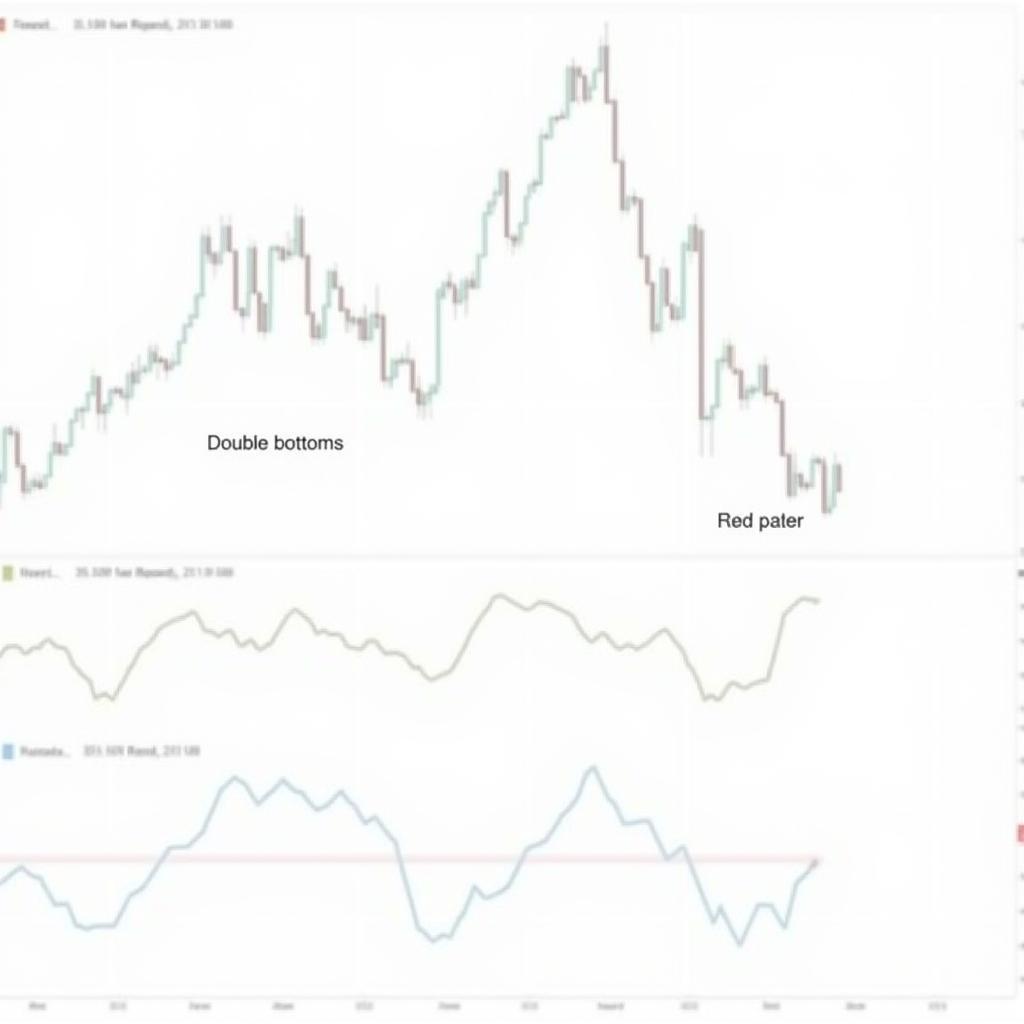

Technical analysis focuses on studying past market data, primarily price and volume, to identify patterns and predict future price movements. It’s a crucial component of learned buy sell and trade strategies as it helps you time your entries and exits more effectively.

- Chart patterns: Identify trends, support, and resistance levels.

- Indicators: Use tools like moving averages and oscillators to gauge momentum.

- Price action: Analyze the raw price movements to understand market sentiment.

Identifying Chart Patterns in Technical Analysis

Identifying Chart Patterns in Technical Analysis

Risk Management: Protecting Your Capital

Risk management is paramount in the learned buy sell and trade process. No matter how skilled you are, losses are inevitable. Effective risk management helps you minimize potential losses and protect your capital.

- Position sizing: Determine the appropriate amount to invest in each trade.

- Stop-loss orders: Set predetermined exit points to limit losses.

- Diversification: Spread your investments across different assets to reduce risk.

“Effective risk management is not about avoiding losses altogether, but about controlling them within acceptable limits.” – John Smith, Financial Analyst at Global Investment Strategies

Developing a Learned Trading Strategy

Developing a robust trading strategy is crucial for long-term success. This involves combining your knowledge of fundamental and technical analysis with a sound risk management plan.

- Define your trading style: Are you a day trader, swing trader, or long-term investor?

- Develop a trading plan: Outline your entry and exit rules, risk tolerance, and profit targets.

- Backtest your strategy: Test your plan on historical data to evaluate its effectiveness.

The Psychology of Trading

The psychological aspect of trading is often overlooked, but it’s just as important as the technical and fundamental aspects. Managing your emotions, staying disciplined, and avoiding impulsive decisions are essential for long-term success.

- Emotional control: Avoid fear and greed, which can lead to poor decisions.

- Discipline: Stick to your trading plan and avoid impulsive trades.

- Patience: Don’t expect to get rich quick. Trading is a marathon, not a sprint.

“Mastering the psychology of trading is just as important as mastering the technical aspects. It’s about controlling your emotions and making rational decisions.” – Maria Garcia, Trading Psychologist at Mindful Trading Solutions

Conclusion

Learned buy sell and trade strategies are essential for navigating the complexities of the financial markets. By combining fundamental and technical analysis with a robust risk management plan, you can increase your chances of success. Remember, continuous learning, adaptation, and emotional control are key to achieving your trading goals.

FAQ

- What is the difference between fundamental and technical analysis?

- How can I develop a successful trading strategy?

- What are the most important risk management techniques?

- How can I manage my emotions while trading?

- What are some common trading mistakes to avoid?

- What are the different types of trading styles?

- How can I improve my trading skills?

For any assistance or further information, please contact us at Phone Number: 0963418788, Email: [email protected] or visit our office at 2M4H+PMH, Phường Nghĩa Thành, Gia Nghĩa, Đắk Nông, Việt Nam. Our customer support team is available 24/7.